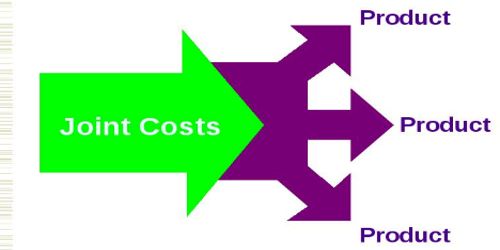

Joint Product and Joint Cost

Joint product: Two or more outputs generated simultaneously, by a single manufacturing process using common input, and being substantially equal in value. Joint products (such as butter. cheese, and cream from milk, and fuel oil, gasoline, and kerosene from crude oil) are separately unidentifiable and incur undifferentiated joint costs until they reach the split-off point. A joint product is the term used when two or more products arise simultaneously in the course of processing, each of which has a significant sales value in relation to each other. Example: The processing of crude oil can result into the joint products kerosene, gasoline, jet fuel, and asphalt, as well as other petrochemical derivatives.

Joint cost: Two or more outputs generated simultaneously, by a single manufacturing process using common input, and being substantially equal in value. Joint products (such as butter, cheese, and cream from milk, and fuel oil, gasoline, and kerosene from crude oil) are separately unidentifiable and incur undifferentiated joint costs until they reach the split-off point. In accounting, a joint cost is a cost incurred in a joint process. Joint costs may include direct material, direct labor, and overhead costs incurred during a joint production process. Example: Let’s consider an oil refinery. The refinery takes crude oil and refines it into a substance that may be used for auto gasoline, motor oil, heating oil, or kerosene. All of these various outputs come from a single input – crude oil. In both of these examples, a single input yields multiple outputs.