Insurance Policy Method of Calculating Depreciation

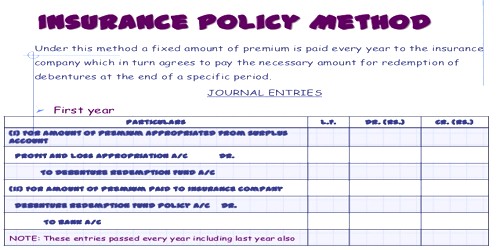

According to this method, Insurance policy is taken for the amount of the asset to be replaced. The amount of the policy is such that it is sufficient to replace the asset when it is worn out. A sum equal to the amount of depreciation is paid as premium every year. The amount goes on accumulating at a certain rate of interest and is received on maturity. In this method, instead of purchasing securities, an insurance policy is purchased for an amount equal to the cost of replacement of assets. The amount so received is used for the purchase of new asset, replacing the old one. The Insurance Company agrees to pay a lump sum in return for a sum known as a premium to be paid at the beginning of every year.

This method is similar to the Depreciation Fund Method. Under this method, Insurance policy is taken from an insurance company. The procedure is the same as the Depreciation Fund Method except that the amount of investment will be in the form premium paid on the insurance policy. The policy is taken for such a period that it matures when the asset is to be replaced. The premium is paid at the beginning of each year and debited to Depreciation Fund Policy Account.

Generally, interest is not recorded yearly in this method. The annual depreciation will be equal to the amount of annual premium and is debited to the Profit and Loss Account and credited to Depreciation Fund Account at the end of the accounting year. When the policy matures, the agreed sum is received from the Insurance Company and is used to purchase the new asset.

Under this method, it not only provides funds for the replacement but also provides security to the asset. When the policy is taken, the asset is secured against any loss. The system is applicable to costly wasting assets. The asset account remains at its original cost.

The advantage of this method is that a definite amount is received on maturity Under Deprecation Fund Investment; there may be lost when the investments are sold and this risk is avoided here. There is also more secure. However, the Profit and Loss Account is overburdened with Deprecation together with repairs.

Merits (Insurance Policy Method):

- It provides adequate funds for the replacement of assets.

- Better security is provided to the investors by an assumption of risk by Insurance Companies.

- The Insurance Company will pay a stipulated amount with which replacement of assets can be made.

Demerits:

- This method is more expensive since the Insurance Company keeps its own margin.

- When the policy is surrendered for one reason or another, there is a greater loss.

- The method is unsuitable, where additions are made to assets during the period.