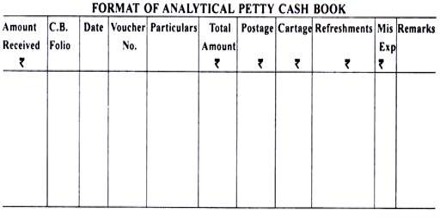

Format of Analytical Petty Cash Book

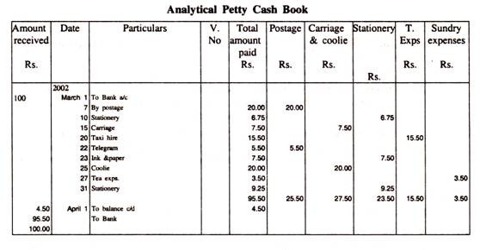

In big business apprehensions, the petty cash book is maintained in analytical form, with a detach column for each standard item of expense and a column for total. This kind of Petty Cash Book is known as Analytical Petty cash Book. One major advantage of this system is that it saves time. Also, it will facilitate the accountant or the organization to evaluate the expenses under the dissimilar various heads. All petty payments are to be classified into different heads and different columns are maintained.

Explanation of columns in the analytical petty cash book:

- Receipts:

This is the primary column of the petty cash book. The amount received by the petty cashier for assembly petty expenses and the opening balance of petty cash will be recorded in this column. Each transaction recorded in the books of accounts goes through – the journal, ledger and the Petty cash book, these three main accounts in order to get captured.

- Cash Book Folio Number (C.B.F.N):

In this column, we write the page number of the cash book where cash paid by the cashier is recorded. From the beginning of the Journal, the Ledger account is ready, with the help of which the final book of accounts of the company is prepared.

- Date:

In this column, the date of receipt/payment of cash is recorded.

- Particulars:

This column records the details of the receipts/payments. Cash received, in the beginning, is shown as ‘To cash’ and all the petty expenses are shown as ‘By expenses’ (name of the expense). However, there are a number of transactions throughout the usual way of the business which is of the very petty and nominal amount and is not recorded in the cash book account.

- V.N.:

The serial number of the voucher (cash payment) is written in this column.

- Total Payments:

This column records the amount of every expense. At the end of the week or month expenses are totaled and afterward balanced. The whole expenses of the week or the month are compared with the total of the receipts column and the balance is obtained. For transactions of such nature, Petty Cash Book is used.

- Postage and Telegrams:

This column records postal expenses like a postcard, envelope, inland letter, postage stamps, registered letter, parcel, telegrams, and telephone charges. In the analytical version, a dividing column is used for each usually happening item of expenses such as stamps, postage & handling, stationery, wages, etc.

- Printing & Stationery:

It includes expenses incurred for purchasing materials such as paper, ink, pencil, eraser, carbon paper and other items of stationery.

- Cartage / Freight / Carriage:

In this column carriage inward of goods is recorded. It includes cartage paid to a coolie, tempo changes, etc.

- Traveling Expenses / Conveyance:

In this column fare for hiring autorickshaw, bus, train, taxi, etc., are recorded.

- Office Expenses & Repairs:

Minor repairing charges and petty office expenses like cleaning are included in this column.

- Sundry Expenses / Sundries:

A column for “sundries” is generally added for miscellaneous payments. Generally columns of important petty expenses of the business according to the nature and type of business are prepared. In addition to these important expenses, there may be certain expenses, which may not have specific columns for them. When a petty expenditure is recorded on the right-hand side of the book, a similar amount is also recorded in the appropriate expenditure column. Expenses like refreshments, charity, tips, the amount paid to scavengers, etc., are recorded in this column.

- L.F.:

This refers to the page number of the ledger where the respective account is recorded.

- Personal Accounts:

A small amount of money paid to individuals is entered in this column.