Single Entry System is a partial, erroneous, unempirical and disorganized method of bookkeeping. It is focused on the results of a business that are reported in the income statement. It can be preserved simply by the business holder. So, this method of book-keeping is easy to keep up and simple to carry out.

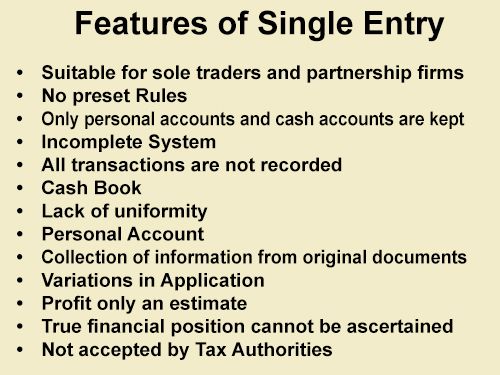

Features of Single Entry System – The following are the major features of single entry system:

- Suitable for sole traders and partnership firms

The single entry system is suitable only for sole traders and partnership firms. Companies cannot keep books on single entry system because of legal provisions.

- No preset Rules

This system is not guided by a fixed set of accounting rules for formative the amount of profit and preparing the financial statements.

- Only personal accounts and cash accounts are kept

In this system, it is very common to keep only personal accounts and to avoid real and nominal accounts. It also keeps one cash book which mixes up business as well as private transactions.

- Incomplete System

This system is an imperfect method of accounting, which does not prove all the aspects of financial transactions of the business.

- All transactions are not recorded

All business transactions are not recorded in the books of account. Some of them are recorded in the books of accounts, certain transactions are noted in the diary and some of them are in the memories.

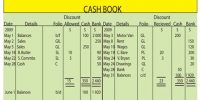

- Cash Book

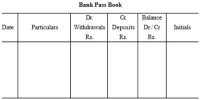

This system maintains a cash book for recording cash receipts and payments of the business organization throughout a given period of time.

- Lack of uniformity

This method lacks uniformity as it is a mere adjustment of the double-entry system, according to the convenience of the individual.

- Personal Account

This system maintains individual accounts of all the debtors and creditors for determining the number of credit sales and credit purchases throughout a given period of time.

- Collection of information from original documents

It is rather often seen that for information one has to depend on original vouchers. For example to know total purchases and sales, one has to depend on copies of invoices.

- Variations in Application

This system has no permanent set of principles for recording financial transactions and preparing diverse financial statements. Hence, it has variations in its function from one business to another.

- Profit only an estimate

Profit under this system is only an estimate.

- True financial position cannot be ascertained

True financial position cannot be ascertained as Balance Sheet is not prepared due to the absence of nominal and real accounts.

- Not accepted by Tax Authorities

Due to incompleteness, inaccuracy, and unsystematic nature, it is not accepted by tax authorities.

Special Features of Single Entry System – On the basis of the previous explanation of the single entry system, it is feasible to specify its particular features as:

- It maintains individual accounts and cashbook, though real and nominal accounts are not maintained.

- There is usually no record of real and individual accounts and in the majority of the cases, documentation is set aside for cash transactions and personal accounts.

- It depends on original documents, e.g, receipts/vouchers, and an authorized/seal attached data.

- There are no permanent standards to follow, cash book mixes up dealing and personal transactions of the owners.

- It is flexible in its operations. Profit under this method is simply an approximate and therefore accurate and exact profits cannot be resolute.

- There is no consistency in maintaining the records and the method might fluctuate from firm to firm depending on the requirements and convenience of each firm.

- It is mainly inexpensive and appropriate for small business, sole trader or partnership firm.

This system is usually found in sole trading concerns or even in partnership firms to some extent but never in the case of limited accountability companies on account of legal necessities.